Revolutionary Impact of Cryptocurrencies and Bitcoin on the Financial Industry and Global Economy

Cryptocurrencies and Bitcoin have revolutionized the financial industry and the global economy as pioneers of digital money and innovative technology over the past decade. In this article, we delve deep into the comprehensive examination of the impact of cryptocurrencies and Bitcoin on the global economy.

Part One: Definition of Cryptocurrencies and Bitcoin

Blockchain technology, as the primary support for cryptocurrencies, particularly Bitcoin, has had significant effects on industries and the global economy. Below, we highlight some of the main impacts of blockchain technology:

- Security and Trust: One of the most significant advantages of blockchain is providing high security and trust in financial transaction systems. Through robust encryption and distributed networks, blockchain enables verification and registration of transactions without the need for centralized intermediaries. This reduces fraud and unauthorized alterations in data and transactions.

- Elimination of Central Intermediaries: Blockchain enables direct transactions between individuals and reduces the reliance on central financial intermediaries like banks. This allows users to minimize transaction costs and benefit from faster and more efficient transactions.

- Transparency and Immutability of Data: Blockchain facilitates public access to recorded data, making all transactions visible to the public. This transparency plays a vital role in reducing corruption and fraud. Additionally, recorded data on the blockchain have low mutability, meaning that unlike traditional financial transactions that may be subject to change, blockchain transactions are immutable and permanent.

- Additional Features: Blockchain provides the ability to offer additional features and innovations. For example, it enables the sending and exchange of decentralized digital assets such as tokens, the creation of smart contracts that can facilitate specific conditions for transactions, and even ecosystem platforms that facilitate the development of innovative applications related to cryptocurrencies.

As blockchain technology is still in the early stages of development, these impacts are expected to increase significantly in the future. With continued research and technological advancements, blockchain is likely to become one of the primary tools for the digital economy and financial transactions in the future.

Part Two: Impact of Cryptocurrencies and Bitcoin on the Global Economy

Cryptocurrencies, especially Bitcoin, have had notable impacts on the global economy. Here are some of these impacts:

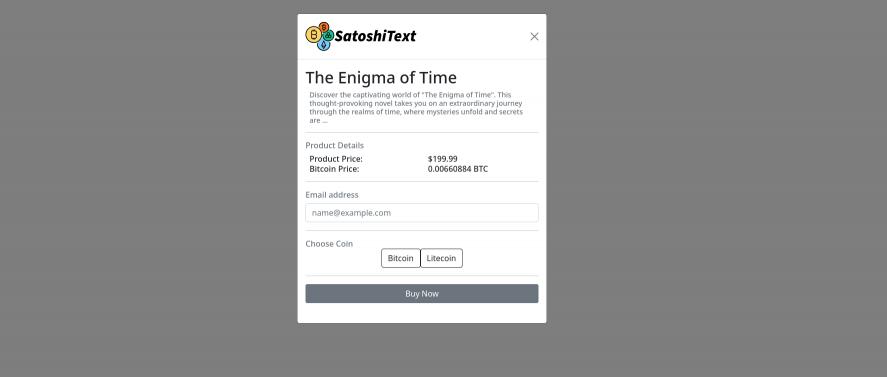

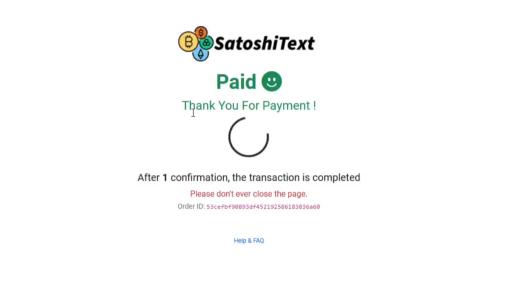

- Role as a Means of Payment: Bitcoin and cryptocurrencies serve as digital payment instruments, enabling quick and international transfers without the need for central financial intermediaries. This can lead to increased commercial facilitation and rapid asset transfers on a global scale.

- Impact on the Financial Industry: Cryptocurrencies and Bitcoin have significant effects on the financial industry as competitors to the traditional banking system. This technology can reduce costs and time required for financial transactions and assist in eliminating central financial intermediaries. Furthermore, cryptocurrencies can be used as tools for asset transfer and storage.

- Banking Accessibility for Youth and Developing Countries: Cryptocurrencies and Bitcoin provide access to financial services for youth and developing countries. In many regions with limited access to traditional banking services, individuals can easily access financial services and facilitate e-commerce using cryptocurrencies.

- Reduction in Transaction Costs: Cryptocurrencies can significantly reduce the costs of financial transactions. This is particularly beneficial for sending money between countries and international transactions, as traditional banking and currency conversion costs are usually high.

- Transformations in the Capital Market: Cryptocurrencies, especially Bitcoin, are recognized as a new asset class in the capital market. Individuals and investors consider them as investment opportunities. This leads to significant volatility in the cryptocurrency market, which is influenced by factors such as regulations, media coverage, and technological changes.

As technology continues to advance in the realm of cryptocurrencies and Bitcoin, we are likely to witness further and broader impacts on the global economy. Their role and influence remain subjects of discussion and examination for organizations, governments, and economists.

Conclusion

Ultimately, the article concludes with a summary. This section emphasizes the importance and potential of cryptocurrencies and Bitcoin in the future of digital money and their positive impact on the global economy.